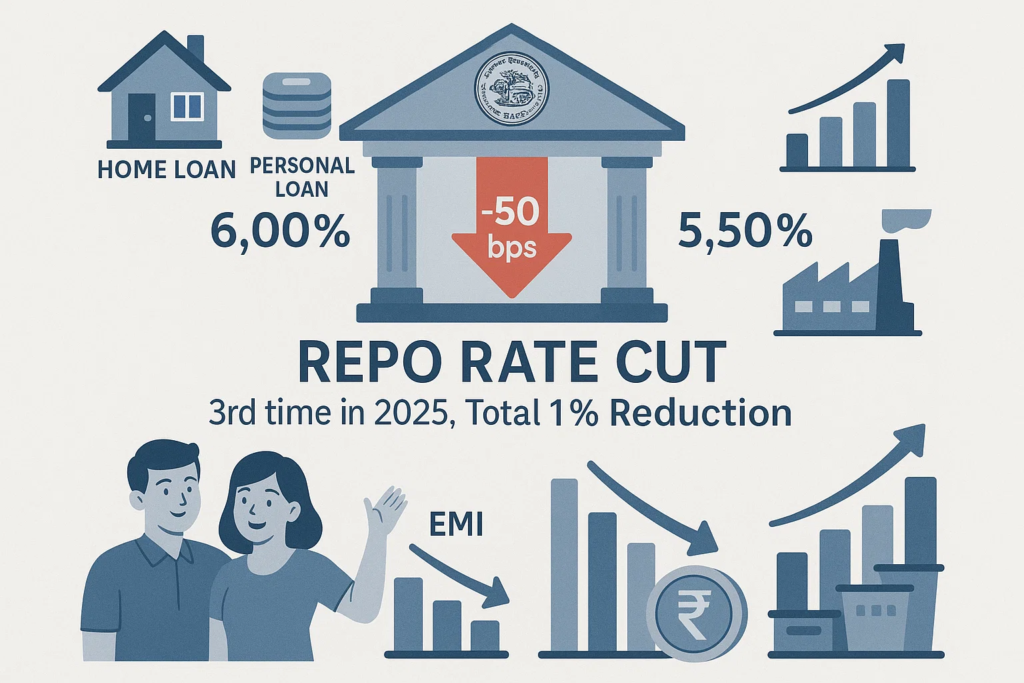

In this outstanding bid to revive the economy, the Reserve Bank of India (RB) has recently lowered the repo rate by 50 basis points which were set at 6.00 that has now been lowered to 5.50 with an intention of fuelling growth. It is the third cut in the repo rate this year and a full percentage reduction has occurred since February. A decision to cut rates has been made in the low inflationary period, when consumption demand is also slowing and this indicates the intent to reduce the cost of borrowing and bring the economy on a growth track again.

This article breaks down what this repo rate cut means for different types of borrowers, especially those with home loans, personal loans, auto loans, and business loans.

What Is the Repo Rate?

The repo rate is the interest rate at which the RBI lends money to commercial banks. When the RBI reduces this rate, borrowing becomes cheaper for banks, which in turn can offer loans at lower interest rates to consumers and businesses.

How Does a Repo Rate Cut Affect You?

1. Reduced EMIs on Floating-Rate Loans

If you have a loan linked to the RBI’s repo rate, especially a home loan taken after 2019 under the external benchmark lending rate (EBLR) system, this rate cut directly impacts you. A 50 basis point cut can lead to a noticeable reduction in your Equated Monthly Installments (EMIs).

- A ₹1 crore home loan for 20 years may see a monthly EMI reduction of approximately ₹3,100–₹3,500.

- Even a ₹40 lakh loan can result in savings of ₹2,000–₹2,600 per month.

This makes homeownership and long-term financing more affordable.

2. Repo-Linked vs MCLR-Linked Loans

There are different types of loan interest rate regimes:

- Repo-Linked Loans (RLLR/EBLR): These get adjusted within one to three months of any repo rate change.

- MCLR-Linked Loans: These may take longer to reflect the impact and depend on bank-specific internal calculations.

- Fixed-Rate Loans: These remain unaffected by the repo rate cuts unless you choose to refinance.

Tip: If your loan is still under MCLR, consider switching to a repo-linked loan to get faster and full transmission of rate cuts.

3. Lower Interest on New Loans

If you’re planning to take a home, auto, education, or business loan, this is a great time. Most public and private sector banks are already passing on the benefits of the rate cut by reducing their lending rates.

This means your loan eligibility may improve, your EMIs will be lower, and you could afford a higher loan amount with the same monthly budget.

Other Economic Implications

Boost for Real Estate and Consumer Spending

A fall in interest rates normally increases demand in real estate industry. Due to low EMIs, the number of individuals thinking of owning a home rises, leading to the growth in residential as well as commercial sector.

Impact on Fixed Deposits and Savings

Lowering the repo rate is useful to the borrowers but it is disadvantages to the savers. The banks are also expected to reduce their fixed deposit (FD) interest rate and this may diminish the appeal of conventional saving products. Investors can always seek the relative higher returns in the debt funds mutual funds or the market.

Increase in Liquidity

The Cash Reserve Ratio (CRR) was also cut by 100 basis points by RBI. The action will facilitate liquidity of the banking system in order to have increased money on loan to the banks.

Also Read:

What Should Borrowers Do Now?

1. Check Your Loan Type

Find out whether your loan is linked to the repo rate or MCLR. If it’s repo-linked, your EMI should reduce automatically. If not, consider switching.

2. Monitor Your Loan Statement

Keep an eye on your bank’s communication and your monthly statements to ensure that the lower rates are being passed on to you.

3. Consider Refinancing

If your current loan is under MCLR or fixed-rate and your bank isn’t passing on the benefits, explore refinancing with another lender offering repo-linked loans.

4. Evaluate New Loan Opportunities

With lower rates, it might be a good time to consider long-pending plans like home renovation, purchasing a vehicle, or even expanding your business.

5. Rebalance Your Investments

If you rely heavily on FDs for income, consider diversifying into other instruments like short-term debt funds or high-yield bonds

The RBI’s recent 50 basis point repo rate cut is a positive signal for the economy and especially beneficial for borrowers. Whether you’re an existing borrower or planning to take a new loan, this rate cut offers opportunities to reduce your borrowing costs significantly.

Act now—review your loan, explore refinancing, and make the most of this policy-driven window to lower your financial burden.

Frequently Asked Questions

1.What is a repo rate and why does it matter for loans?

The repo rate is the rate at which the Reserve Bank of India (RBI) lends money to commercial banks. Changes in the repo rate directly affect the interest rates on loans provided by banks.

2.What does a 50 basis points (bps) repo rate cut mean?

A 50 bps repo rate cut means the RBI has reduced the lending rate by 0.50%, making borrowing cheaper for banks, which can lead to lower loan interest rates for consumers.

3.How will this repo rate cut affect home loans?

Home loan interest rates may decrease, resulting in lower EMI payments or reduced loan tenure for borrowers, depending on the lending bank’s policy.

4.Will all loans be cheaper after the repo rate cut?

Not necessarily. While banks may pass on the benefits of the rate cut, some lenders may adjust only a portion of the interest rate or take time to reflect changes in loan offers.

5.How does this cut impact personal loans and car loans?

Personal loans and car loans may also see reduced interest rates, making them more affordable and encouraging borrowers to take loans for essential or discretionary purchases.

6.Can existing loan borrowers benefit from this repo rate cut?

Yes, existing borrowers with floating interest rates can benefit if their lender revises the EMI or tenure based on the lower repo rate, but fixed-rate loans may not be impacted.

7.Will this rate cut boost the real estate market?

A lower repo rate can encourage more homebuyers to apply for loans due to affordable financing options, thereby boosting demand and growth in the real estate sector.

8.How should borrowers prepare for this rate cut?

Borrowers should check with their lenders, review current loan terms, compare offers from different banks, and explore refinancing options to take advantage of lower rates.

9.Are there risks in applying for loans after a rate cut?

While borrowing becomes cheaper, borrowers should still assess their repayment capacity, avoid over-borrowing, and ensure that they understand loan terms before proceeding.

10.Where can borrowers find the latest updates on repo rates and loan offers?

Updates can be found on the official RBI website, bank announcements, financial news platforms, and by consulting loan advisors or certified financial consultants.