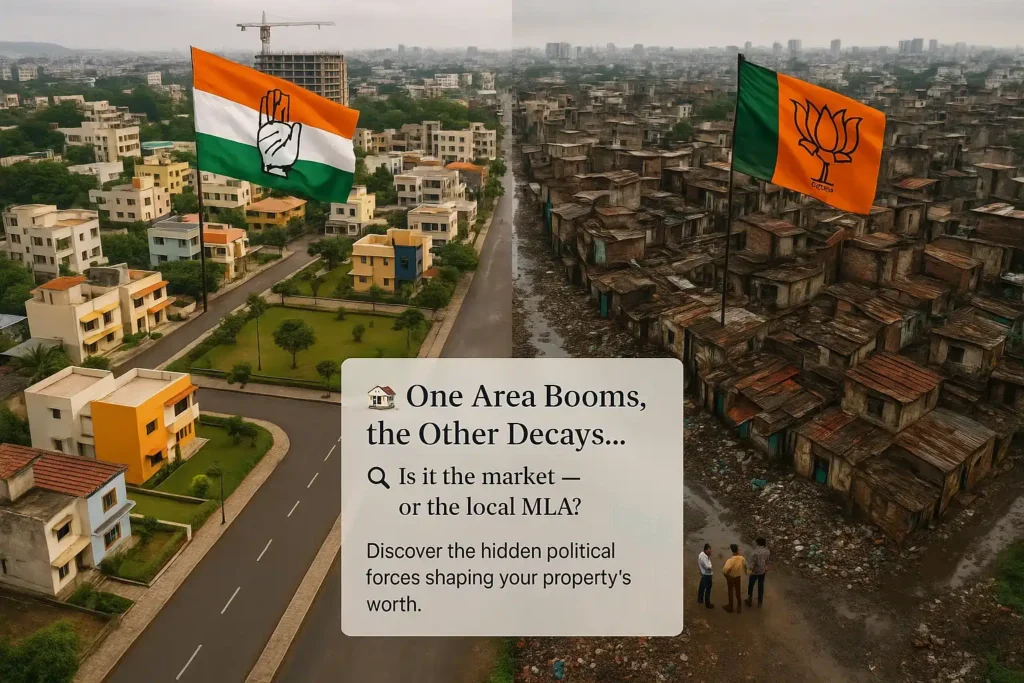

Most individuals when they refer to property values, they refer to the location, infrastructure as well as market demand. However, there is one other invisible force that influences the prices, local politics. In India, the whims and fancies of municipal authorities, state governments, and even local political leaders will dictate whether a property will appreciate or not in silence.

Politics directly, and can be underestimated, is involved with real estate through circle rate changes to zoning approvals. We shall see how this applies in India.

1. Infrastructure Announcements: Political Influence on Growth Corridors

One of the biggest factors driving property values is infrastructure development.

- A good example is the Dwarka Expressway in Gurgaon. It was announced nearly twenty years ago, construction was delayed by land acquisition problems, change of contractor and change in political priorities. Prices of property along the corridor went high and low after election promises, project tenders and court cases. Today, as it is almost completed, the prices are already higher by 30-40% over the past 3 years (Knight Frank Report 2024).

- In the same line, the Mumbai Metro expansions and Coastal Road Project experienced massive speculative price hikes in related micro-markets directly after political announcements, prior to its completion.

Fact: JLL India (2023) states that property prices in locations surrounding major building projects increase 20-25 percent when construction starts and can increase 40-60 percent when it completes.

2. Circle Rates and Stamp Duty Controlled by State Governments

Local governments determine the circle rates (guideline values) – the lowest value in which a property transaction can be registered. Circle rate increases or freezes are politically determined and they have direct effects on affordability and investor appetite.

- The Haryana government revised circle rates in Gurgaon, (202425) and raised the rates by 10-15 percent in all the sectors. This had an instant effect of increasing transaction cost, stamp duty outflow and reducing the gap between the market and official rates.

- Conversely, in Noida and Greater Noida, the authorities have maintained circle rates at relatively lower rates to attract investment in low cost housing and large scale residential projects.

Fact: A report by ANAROCK (2024) shows that areas with frequent circle rate hikes tend to see slower demand, as buyers postpone purchases to avoid higher registration costs.

3. Land Acquisition & Approvals: Political Gatekeeping

Any real estate project in India must undergo several approvals or clearances, such as environmental, municipal, and land-use change approvals. Local political interference of such processes forms bottlenecks or speeds up growth.

- Faridabad Metro Extension faced delays due to political disagreements over funding contributions between Haryana and Delhi governments. Property prices near Ballabhgarh and Old Faridabad stagnated for years as a result.

- In Maharashtra, certain industrial belts saw a sudden jump in land values after political clearance was given for industrial townships under MIDC.

Expert View: Property consultants like CBRE India highlight that political control over land-use change permissions can decide whether an area becomes a residential hub or remains an agricultural backwater.

4. Elections and Vote-Bank Driven Development

Elections often trigger populist policies that directly affect real estate.

- Loan waivers and subsidies reduce developer cash flow and delay projects in rural areas, indirectly impacting land values.

- Governments frequently announce big-ticket projects before elections—airports, highways, smart cities. For instance, the Jewar Airport project near Noida was accelerated ahead of the Uttar Pradesh elections, fueling a property boom in nearby sectors.

Fact: A NITI Aayog analysis (2022) observed that over 60% of major infrastructure projects in India were announced within 2 years of a state or central election cycle.

5. Urban Planning & Local Bodies: Silent Power Brokers

Municipal corporations and development authorities—largely influenced by political leadership—decide zoning, FAR (Floor Area Ratio), and density rules.

- In Bengaluru, frequent changes in BBMP zoning laws have allowed high-rise approvals in some localities, pushing up land prices overnight.

- In Delhi, restrictions under the Delhi Master Plan 2041 on farmhouses and unauthorized colonies continue to impact land valuations, depending on political will to regularize them.

Proof: The Delhi government’s decision in 2019 to regularize unauthorized colonies immediately increased land values in those areas by 25–30%, as per Magicbricks Research.

6. Law, Order, and Political Stability

Political stability is often overlooked but crucial. Investors avoid areas where local politics lead to unrest, frequent protests, or litigation.

- Most real estate investments in large-scale industries were discouraged in West Bengal due to protracted land acquisition fights (e.g. Singur, Nandigram).

- However, Ahmedabad and Gandhinagar developed into robust real estate development centres because of stable governance in Gujarat over the last twenty years.

Fact: A World Bank study (2020) ranked Indian states on “Ease of Doing Business,” and states with stable governance consistently attracted higher FDI in real estate and industrial land.

Key Takeaway for Investors

Local politics may not be visible in glossy brochures or property listings, but it silently dictates property values. For Indian buyers and investors, ignoring political influence is risky.

Before investing, always ask:

- Is there upcoming infrastructure influenced by political promises?

- Are circle rates likely to be revised soon?

- Does the local authority have a history of fast or delayed approvals?

- How politically stable is the state or city?

A property’s future ROI often depends less on its physical location and more on its political location.

In the case of the Indian real estate market, politics and property cannot be separated. Whether it was circle rates, master plans, metro projects or airport clearances, the influence of local politics is the silent driver of price trends. Intelligent investors do not only monitor a market, but also follow the political pulse within the region, before making big-ticket decisions.

Conclusion

To sum up, local politics have a much stronger influence on the level of the property value than the majority of purchasers admits.Political leaders can directly influence real estate prices through zoning modifications, infrastructure approvals, permit delays, and selective development incentives — either positively or negatively. Regions supported by strong political will experience rapid appreciation due to better roads, metro connectivity, and civic upgrades, while politically neglected areas often stagnate or decline. Thus, clever investors need to invest more than the brochures and advertisements to know the political situation in their location of choice. Being aware of local governance, policy changes, and election results may be a great way to know future property performance. The point is that it is not only intelligent to know the politics of the property to make profitable long term real estate investments in India.

Frequently asked questions FAQs

1. How do local politics affect property values in India?

Local politics influence property values through policy decisions, zoning regulations, infrastructure approvals, and land-use permissions. Politically favored areas often receive faster development, boosting property appreciation.

2. What role do local politicians play in real estate development?

Local politicians often control the pace of approvals for infrastructure projects, building permits, and land conversions. Their influence determines which neighborhoods see growth and which remain underdeveloped.

3. Why do some areas develop faster than others politically?

Areas represented by politically influential leaders or aligned parties often receive quicker approval for public works like roads, sewage systems, and metro connectivity — all of which raise property demand and value.

4. How does local governance influence infrastructure growth?

Municipal bodies and local councils, often guided by political agendas, control infrastructure development timelines. Their priorities decide which areas receive upgraded roads, drainage, and connectivity — all key factors that drive property valuation.

5. How can homebuyers protect themselves from political risks?

Buyers should:

- Invest in RERA-registered projects for legal protection.

- Research long-term government master plans.

- Choose locations with diversified political representation.

- Track infrastructure projects with confirmed funding instead of mere promises.