Home purchase is one of the greatest investments that a person makes in his life. As the number of real estate frauds, delays in the projects, and other misleading practices increased, the Indian government came up with the RERA Act to safeguard the homebuyers and ensure transparency within the property sector in 2016. This blog will address the pros and cons of the RERA Act, its significance, and its effect on the buyers and developers in India, including the Haryana RERA Act.

What is the RERA Act?

The Real Estate (Regulation and Development) Act, 2016, is the full form. It is mainly aimed at controlling the real estate market, creating clarity as well as protecting the interests of homebuyers. The act has stipulated that registration of all real estate projects larger than a specified size should be conducted with the corresponding state RERA authority prior to advertising or selling them. Project developers must reveal details of the project, meet deadlines, and implement standard procedures. Before buying a property we need to understand RERA, so meet our RERA Certified Property Consultancy who will give you best explanation.

Importance of the RERA Act

The RERA Act is significant because it has established a just and responsible real estate market. It guarantees that shoppers are no longer defrauded or cheated by developers of delays in projects and misuse of funds. The act also helps in rebuilding a better standard by ensuring legal protection, which makes the property market better and more dependable. The Haryana RERA Act has enhanced transparency and confidence of buyers in such states as Haryana.

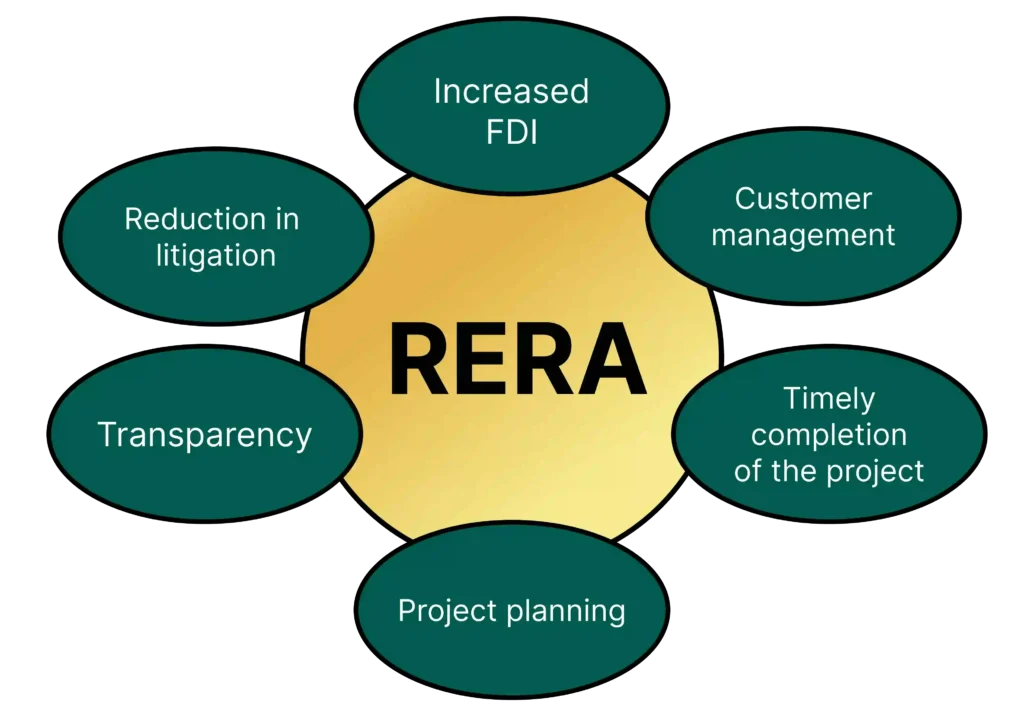

Advantages of the RERA Act

The advantages of the RERA Act benefit both homebuyers and developers.

For Homebuyers:

- Increased Transparency – Projects must be registered, and key details like layout plans, approvals, and construction progress are displayed on state RERA portals.

- Protection Against Fraud – Only registered projects are considered authentic, minimising risks of dealing with unverified builders.

- Standardised Pricing – Carpet area is calculated using a uniform method, preventing inflated property costs.

- Protection of Funds – Developers must deposit 70% of project funds into an escrow account dedicated to that project, ensuring proper utilisation.

- Limit on Advance Payments – Developers can collect a maximum of 10% as booking fees after signing a registered sale agreement.

- Compensation for Delays – Buyers receive interest or penalties if projects are delayed.

- Liability for Structural Defects – Builders are responsible for structural issues for up to five years post-possession.

- Faster Dispute Resolution – Dedicated RERA authorities and ombudsmen provide time-bound solutions for complaints.

For Developers:

- Market Confidence – Increased transparency builds buyer trust and improves sales potential.

- Standardised Operations – Clear rules and regulations help streamline project execution.

- Systematic Funding – Escrow accounts ensure organised financial management for each project.

Disadvantages of the RERA Act

While the RERA Act has many benefits, it also comes with certain challenges.

For Homebuyers:

- Limited Scope for Older Projects – Projects launched before 2016 are often excluded.

- Awareness Gap – Many buyers remain unaware of their rights under the act.

For Developers:

- Increased Compliance Costs – Documentation, registration, and reporting lead to higher operational costs.

- Project Delays – Mandatory approvals before registration can lengthen project timelines.

- Reduced Liquidity – Escrow account rules limit access to project funds for other ventures.

- Impact on Smaller Projects – Small developers may face difficulties complying with strict regulations.

- Inconsistent Implementation – Enforcement varies across states, creating confusion and uneven application.

Key Features of the RERA Act

| Feature | Description |

|---|---|

| Focus | Protect buyers, promote transparency, regulate real estate sector |

| Registration Requirement | Mandatory for projects above specified size |

| Escrow Account | 70% of project funds to be used only for that project |

| Advance Payment Limit | Max 10% before signing sale agreement |

| Carpet Area Standardization | Uniform method to calculate usable property area |

| Developer Liability | Responsible for structural defects up to 5 years |

| Dispute Resolution | Dedicated authority and appellate tribunals for faster grievance handling |

| State-Level Implementation | Authority varies; example: Haryana RERA Act |

Why RERA is Important

The RERA Act is significant in that it regains confidence in real estate trade, minimises fraudulent actions, and ensures the delivery of projects is timely. To the purchasers, it offers legal protection, transparency and financial security. To developers, it introduces uniformity and reliability in the market. In sum, the significance of RERA is that it provides a more efficient, less risky property environment that will be beneficial to all the stakeholders.

Conclusion

To sum up, the pros and cons of the RERA Act are its ability to improve the Indian market of real estate. Although it improves transparency, buyer protection, and accountability, still, there are challenges like increases in compliance costs, delays in project implementation, and inconsistency in implementation. To the homebuyers, safer investments can be achieved by knowing what the RERA Act is and utilising its protection. To developers, RERA compliance creates trust and growth in the long-term market. Homebuyers and developers are already experiencing the positive effects of the Haryana RERA Act and other state-wise legislations, which create a fairer and safer property landscape.

Frequently Asked Questions (FAQs) About the RERA Act

1. What is the RERA Act and why is it important for homebuyers?

The RERA Act full form is the Real Estate (Regulation and Development) Act, 2016. It is important because it protects buyers from fraud, ensures timely delivery, and brings transparency to real estate transactions. Buyers can now verify project registration, track construction progress, and seek compensation for delays or defects.

2. What are the advantages of the RERA Act for buyers and developers?

The advantages of the RERA Act include standardised carpet area, protection of funds through escrow accounts, fair compensation for delays, and faster dispute resolution. For developers, RERA builds market confidence, ensures standardised project execution, and strengthens credibility in the real estate sector.

3. Does the Haryana RERA Act differ from the central RERA Act ?

The Haryana government implements the RERA Act at the state level, following the framework of the central RERA Act. It requires all developers in Haryana to register projects, disclose accurate details, and follow regulations, ensuring local enforcement while aligning with the national act.

4. Why the RERA is important for small and first-time homebuyers?

Why RERA is important for first-time buyers is because it limits advance payments, protects funds, and ensures timely delivery. It gives buyers a legal framework to address grievances and reduces the risk of investing in unregistered or non-compliant projects.

5. How can homebuyers check if a project is RERA compliant?

Buyers can visit the official state RERA portal and search for the registered project. This confirms whether the project is legally compliant and provides verified details, including timelines, approvals, carpet area, and developer information, ensuring transparency and confidence before investing.