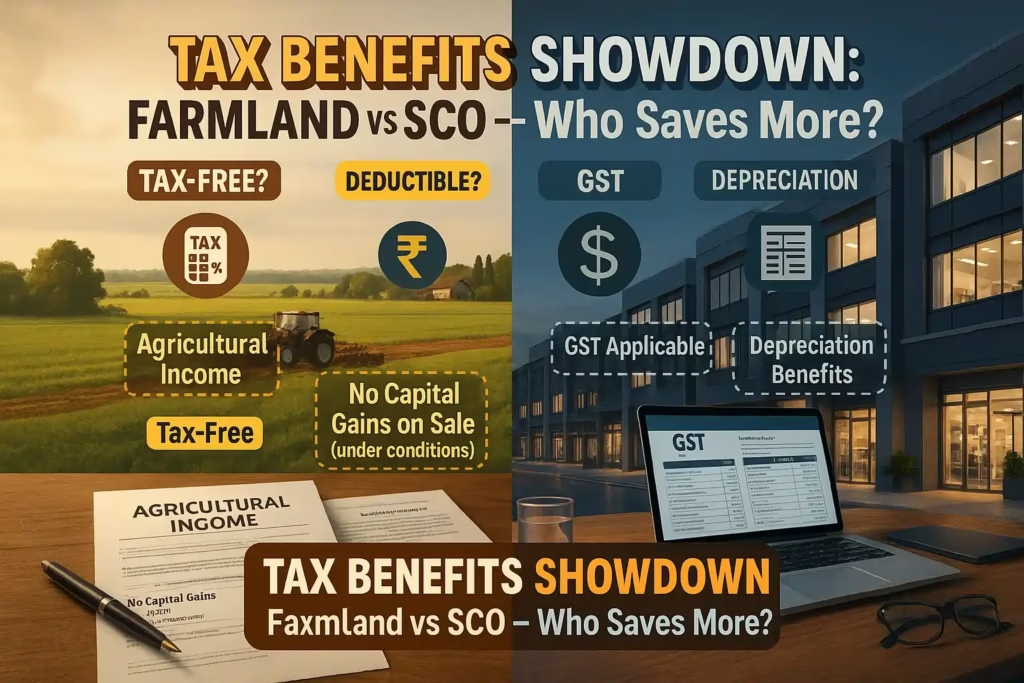

In real estate investment, returns are not just about rental income and appreciation—what you save in taxes can be just as valuable.

Two increasingly popular investment categories in India are farmland and SCO (Shop-Cum-Office) units. While both offer solid asset value, their tax treatment under Indian law is very different.

We’ll break down the tax benefits, exemptions, and liabilities of owning farmland vs SCO units, helping you make smarter financial decisions for 2025 and beyond.

What is Taxable in Real Estate Ownership?

When you own a real estate asset, you typically face tax implications in three major areas:

- Capital Gains Tax – on resale or profit

- Rental Income Tax – on leasing

- Wealth Tax and Property Tax – local or indirect costs

Let’s explore how each of these apply differently to farmland and SCO properties.

1. Capital Gains Tax: Farmland vs SCO

Farmland

Under Section 10(37) and Section 54B of the Income Tax Act:

- Capital gains on rural agricultural land are exempt from tax if:

- The land is classified as rural agricultural (i.e., not within a municipality or corporation limits)

- It was used for agricultural purposes for at least 2 years before sale

- If you reinvest sale proceeds into another agricultural land, you can claim capital gains exemption under Section 54B.

Many investors buy land in places like Naugaon, Sohna, or Palwal—areas close to expressways but still legally classified as “rural”—to benefit from this.

SCO Units

- Treated as commercial assets, so capital gains tax applies in full

- Short-term capital gains (STCG) if sold within 2 years: taxed as per your income slab

- Long-term capital gains (LTCG) after 2 years: taxed at 20 percent with indexation

No exemptions unless reinvested under Section 54EC (into bonds) or under 54F conditions

2. Rental Income Tax: Farmland vs SCO

Farmland

- Income from leasing agricultural land for farming purposes is exempt under Section 10(1) of the Income Tax Act

- No TDS deduction, no GST if the activity is purely agricultural

However, if the land is leased for non-agricultural purposes (e.g., weddings, events, solar parks), it may become taxable under “Income from Other Sources”

SCO Units

- Rental income from SCO units is taxable under ‘Income from House Property’

- You can claim 30 percent standard deduction under Section 24(a) for maintenance

- Municipal taxes paid can also be deducted

If you’re paying EMI, you can claim interest deduction under Section 24(b), provided the unit is rented out. GST may be applicable if lease rent crosses ₹20 lakh annually, depending on tenant type and usage.

3. GST and Other Indirect Taxes

Farmland

- No GST applicable if the land is leased for agricultural activity

- Exempt from stamp duty rebates in some states for agricultural land purchases

- No wealth tax implications

SCO Units

- GST of 18 percent may be applicable on construction services or lease of unfinished units

- Full stamp duty applicable (6 to 8 percent in most states)

- Subject to commercial property tax as per local municipal rules

Read More:

- Municipal Tax on Commercial Property

- Rajasthan Property Tax 2025

- Can You Legally Sell a Property in Cash?

- Understanding Agriculture Land Taxation Policy in Rajasthan

4. Income Clubbing and Succession Planning

Farmland

- Agricultural income is not included in total income for income tax calculation

- Helps in tax planning and avoiding higher tax slabs

- Easier to transfer or gift to family members with minimal tax liabilities

SCO Units

- Rental income adds to your total income, which could push you into a higher slab

- Gifts or succession transfers could invoke capital gains or gift tax implications depending on structure

5. Tax Advantages at a Glance

| Category | Farmland | SCO Units |

|---|---|---|

| Capital Gains Exemption | Yes (for rural agri land) | No (unless reinvested via Section 54EC/54F) |

| Rental Income Tax | Usually exempt (if used for agriculture) | Taxable with standard deduction (30 percent) |

| GST on Lease | No (if agri use) | Yes, if lease exceeds ₹20 lakh/year |

| Stamp Duty | Lower in some states | Higher (6 to 8 percent typically) |

| Wealth or Property Tax | Minimal or exempt | Applies as per local bodies |

| Tax Slab Impact | Low (agri income exempt) | High (adds to total income) |

| Reinvestment Benefits | Under Section 54B | Under Section 54EC or 54F only |

Which is More Tax-Efficient?

Choose Farmland If You Want:

- Tax-free rental income (if agri use)

- Exempt capital gains (rural zone)

- Low entry tax (stamp duty, GST)

- Efficient wealth transfer to next generation

Choose SCO Units If You Want:

- Regular rental income (though taxable)

- Deductions under Section 24 and interest benefits

- Business income planning via GST input credits

- Suitable for commercial income portfolios

Optimize Tax and Asset Type Together

Tax benefits should not be the sole reason for investment—but they significantly impact your returns over time.

Farmland offers unmatched tax exemptions if you play by the rules and focus on legal rural zones.

SCO units, while taxable, can generate high returns and benefit from deductions and credits under the right structure.

Need Help Structuring Your Investment?

At The Whitelisted Estate, we help investors not only buy verified farmland and SCO units, but also structure deals for maximum tax efficiency.

- Legal Vetting

- Tax Planning Support

- Land Use Compliance

- Title and Zoning Verification

Call now at 7428812398 for a free consultation or premium advisory on farmland and SCO unit investments in NCR and Rajasthan.

FAQ,s Frequently asked quetions

1. What are the key tax benefits of investing in farmland in India?

Farmland investors can claim agricultural income exemptions under Section 10(1) of the Income Tax Act, making profits from farming activities tax-free. Additionally, long-term capital gains may be minimized if the land is classified as agricultural.

2. How do tax benefits differ between farmland and SCO (Shop-Cum-Office) ownership?

Farmland offers exemptions on agricultural income, while SCO ownership qualifies for depreciation and interest deductions on loans under business property taxation. The difference lies in the nature of income — agricultural vs. commercial.

3. Can capital gains tax be saved when selling farmland or SCO property?

Yes. For farmland, capital gains may be exempt if the land meets rural classification criteria. For SCOs, reinvesting proceeds under Sections 54F or 54EC in specified assets can reduce capital gains tax.

4. Are there GST implications for owning farmland or SCO properties?

Farmland transactions are typically outside the scope of GST, as they involve agricultural land. SCO ownership, however, may attract GST if the property is leased or used commercially.

5. Which property type offers better long-term tax planning advantages — farmland or SCO?

Farmland provides ongoing income tax exemptions and potential inheritance benefits, while SCOs allow structured deductions for depreciation, maintenance, and business operations — suitable for entrepreneurs seeking regular taxable income optimization.