This is the burning question many property buyers and investors are asking today. For years, the 1% rule was a simple formula used by investors to quickly evaluate whether a rental property could generate strong returns. But with changing property prices, rising interest rates, and evolving rental trends in India and abroad, it’s worth asking: does this rule still hold its weight?

What Is the 1% Rule in Real Estate?

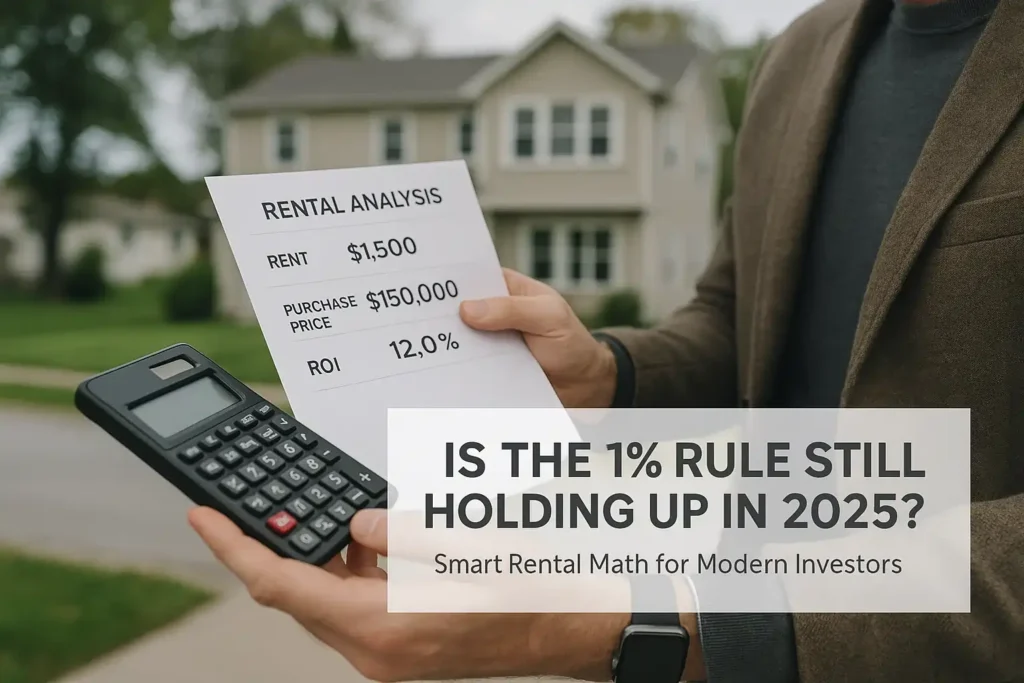

The 1% rule is a quick check investors use to determine if a rental property might generate enough income. According to the rule, a property’s monthly rent should equal at least 1% of the total purchase price.

Example: If a home costs ₹50,00,000, then it should ideally rent for ₹50,000 per month to meet the 1% rule.

This rule is not a guarantee of profitability, but rather a filtering tool to quickly screen out overpriced properties.

Why the 1% Rule Became Popular

- Quick decision-making: Investors didn’t need complex spreadsheets to evaluate properties.

- Risk management: Ensured rent would cover mortgage payments, maintenance, and vacancy risks.

- Consistency: Worked well in markets where property prices were relatively low compared to rental income.

The Reality in 2025 Does It Still Work?

1. Rising Property Prices

In India’s metros like Gurgaon, Noida, Bengaluru, and Mumbai, property values have skyrocketed. Expecting rent to match 1% of the purchase price is often unrealistic.

Example: A ₹1 crore apartment in Gurgaon rarely rents for more than ₹35,000–₹45,000 per month (closer to 0.3%–0.4%, not 1%).

2. Interest Rate Impact

With home loan rates fluctuating between 8%–9%, investors rely more on long-term appreciation rather than just monthly cash flow.

3. Changing Tenant Demands

Co-living, serviced apartments, and short-term rentals (like Airbnb) sometimes break the 1% ceiling. But traditional long-term rentals rarely hit that benchmark in 2025.

4. Regional Variations

The rule may still apply in smaller cities and tier-2 markets like Indore, Lucknow, Jaipur, or Naugaon, where property prices are affordable and rents relatively strong.

Alternatives to the 1% Rule in 2025

Since the 1% rule is less practical today, investors are shifting towards:

- The 0.5% Rule (Realistic in Metros): Many experts now say if your rent is 0.5% of purchase price, it’s acceptable in big cities.

- Cap Rate (Capitalization Rate): Net Operating Income ÷ Purchase Price. A better measure of profitability.

- Cash-on-Cash Return: Compares actual invested money with yearly cash flow. Useful if you’ve taken a loan.

- Appreciation Potential: Looking at infrastructure growth (e.g., Dwarka Expressway, Delhi-Mumbai Corridor) for long-term returns.

The Rule Is a Starting Point, Not a Verdict

The 1% rule in 2025 is less about strict numbers and more about perspective. In fast-growing Indian real estate markets, investors must balance cash flow, appreciation, and financial leverage instead of depending on one shortcut.

So, the verdict?

Still useful as a quick filter in affordable markets. But for metros and premium projects, investors should rely on more comprehensive metrics.

FAQ: The 1% Rule in Real Estate (2025 Edition)

Q1. What exactly is the 1% rule in real estate?

It means your monthly rent should be at least 1% of the property’s purchase price.

Q2. Is the 1% rule realistic in Indian metros like Gurgaon or Mumbai?

Not usually. In metros, most properties fall in the 0.3%–0.5% range.

Q3. Does the 1% rule guarantee profits?

No. It’s just a quick screening tool. You still need to calculate expenses, loan EMIs, and taxes.

Q4. What should investors focus on instead in 2025?

Cap rate, cash-on-cash return, and long-term appreciation are more reliable indicators.

Q5. Where in India can the 1% rule still work?

Tier-2 and tier-3 cities, where property prices are low and rental demand is high.

Q6. Should new investors ignore the 1% rule?

No, it’s a good starting point, but don’t rely on it alone. Combine it with other financial metrics.