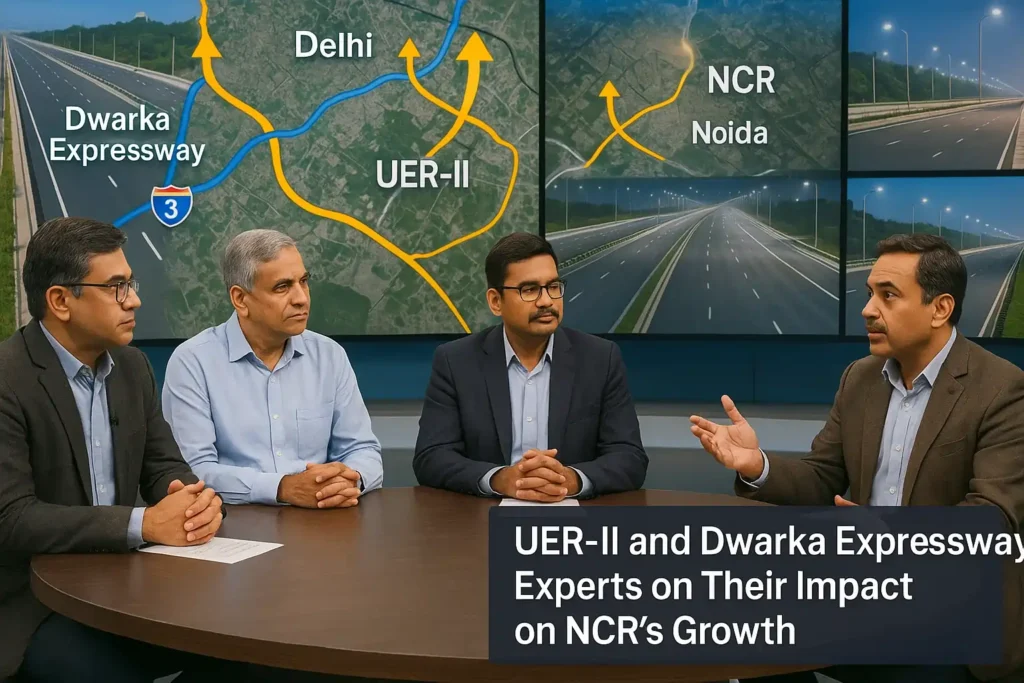

The simultaneous opening of the Urban Extension Road-II (UER-II) and the Delhi stretch of the Dwarka Expressway is a watershed moment for Delhi-NCR infrastructure — improving airport, north-south and west-east connectivity, unlocking peripheral markets (Sonipat, Kundli, Najafgarh, parts of west Delhi), and already re-rating land and housing prices along the corridors. But benefits come with caveats: tolling, local protests, safety and affordability pressures, and the long tail of supporting infrastructure (metros, last-mile links).

What are UER-II and the Dwarka Expressway (brief primer)

- UER-II (Urban Extension Road-II) is a newly completed outer-ring expressway-style corridor that links Delhi’s western and northern edges — providing a faster orbital route that connects NH-44, NH-9 and NH-8 and improves access to Sonipat, Kundli, Bahadurgarh and western Delhi suburbs.

- Dwarka Expressway (Delhi–Gurgaon corridor) is a high-capacity expressway connecting south-western Delhi (Dwarka) with Gurugram and IGI Airport, aimed at reducing Delhi-Gurgaon congestion and shortening commute times. The Delhi stretch has been opened recently, completing critical missing links.

Both projects were inaugurated in 2025 and together represent a major public-investment push (reported combined project value around ₹11,000 crore), aimed at shifting traffic patterns and enabling new development pockets.

How these roads change the geography of opportunity

- Travel times and logistics: UER-II creates a faster orbital alternative to inner city movements — reducing freight and intercity travel times and decongesting radial highways. That improves business case for warehousing, logistics parks and industrial expansion outside core Delhi.

- Airport and city access: The Dwarka Expressway’s improved connection to IGI Airport and Gurugram makes western-edge residential projects much more attractive for air-linked professionals and corporate offices. This has an immediate effect on buyer demand.

- Land assembly & development push: Peripheral towns such as Sonipat, Kundli and areas around Najafgarh and Rohini-extension have become more investable; developers are accelerating launches and land aggregators are active. Analysts expect fresh project launches and more commercial leasing interest along these corridors.

Evidence from the market — what the numbers say

- Price appreciation: Market reports show sharp gains in corridors tied to the Dwarka Expressway — some studies report prices roughly doubling over a recent 3–4 year period, with strong spikes in 2024–25. Analysts estimate another 15–20% potential upside in the near term for land and select housing pockets now that connectivity is in place.

- Demand shift: Developers and brokers report increased enquiries, faster sales velocity for ready/near-ready inventory and stronger traction for higher-end projects that promise quick airport access. Institutional interest in logistics real estate (warehousing near new interchanges) has also risen.

(These are market-level signals — they do not guarantee the same uplift for every micro-location. Local factors — soil, zoning, approvals, and neighbourhood amenities — still matter.)

What experts are warning about

Experts highlight several risks alongside the upside:

- Affordability squeeze: Rapid price gains can push mid-income buyers out of the market unless developers supply mid-segment stock.

- Tolling & local backlash: Toll plazas on new stretches and elevated sections have already triggered protests in some south-west Delhi villages demanding exemptions or reopened U-turns.

- Safety and operations: Road-safety concerns (accident rates, need for enforcement) remain even on upgraded expressways — underlining that infrastructure opening alone does not instantly make a corridor safe. Authorities must combine technology, policing and engineering.

- Supporting infrastructure lag: Benefits are maximized only when last-mile links (metro extensions, arterial flyovers, service roads) and civic services (storm drains, sewage) keep pace — something that often lags behind headline inaugurations.

Sectoral winners and losers (practical view)

Likely winners

- Residential projects with genuine ready connectivity to the expressways (especially ready-to-move inventory).

- Logistics and warehousing near interchanges and industrial nodes — better transit time lowers operating costs.

- Retail / service ecosystems (F&B, hotel, last-mile commercial) that cluster around new interchanges.

At-risk groups

- Peripheral micro-markets with poor internal roads or without regulatory clearances — they may not see the same uplift.

- Buyers investing purely on speculation without factoring in clearance status, completion timelines and developer reputation.

Practical advice for investors, developers and city planners

homebuyers/investors

- Prefer ready or near-ready inventory if you’re banking on connectivity gains in the short term.

- Check micro-location fundamentals (local roads, water, approvals) — not just a project’s “expressway frontage” claim.

- Be cautious about projects on the far fringe that lack phased delivery of civic infrastructure.

developers

- Consider mixed-product portfolios (affordable + mid) to avoid pricing out local demand.

- Coordinate with authorities on access points and service roads; projects sell faster when last-mile works are visible.

planners/authorities

- Address toll and access concerns through stakeholder consultation (monthly passes, local exemptions where justified).

- Invest in road safety, lighting, and patrols — inaugurations must be followed by operations planning.

UER-II and the Dwarka Expressway are transformative pieces of the NCR puzzle: they rewire mobility, open new investment corridors and have already triggered material price adjustments. But smart gains will accrue only where transport upgrades are matched by last-mile infrastructure, safety planning, fair tolling and housing that remains affordable. For anyone deciding now — whether buyer, developer or policymaker — the right approach is granular: location due diligence, buyer-segment fit, and a clear view of short vs long-term timelines.

Frequently Asked Questions (FAQ)

Q1. What is UER-II and why is it important for Delhi-NCR?

UER-II (Urban Extension Road-II) is an outer ring-road style expressway that connects Delhi’s western and northern edges with major highways like NH-44, NH-9, and NH-8. It reduces congestion in central Delhi, improves logistics movement, and opens up new real estate opportunities in Sonipat, Kundli, Bahadurgarh, and Najafgarh.

Q2. How does the Dwarka Expressway benefit Gurugram and Delhi residents?

The Dwarka Expressway directly connects Dwarka in Delhi with Gurugram and IGI Airport. It eases traffic on NH-48, reduces travel time between Delhi and Gurugram, and boosts property demand in residential projects near Dwarka, Gurugram, and surrounding areas.

Q3. Will property prices rise along UER-II and the Dwarka Expressway?

Yes. Real estate prices have already witnessed significant appreciation along the Dwarka Expressway in recent years, and experts predict continued growth. UER-II is expected to have a similar impact, especially in emerging corridors like Sonipat and Kundli, due to improved connectivity.

Q4. Are there risks in investing near these new expressways?

Yes. While connectivity boosts demand, risks include high property prices, potential toll charges, delayed supporting infrastructure (metros, drainage, service roads), and affordability issues. Investors should carefully evaluate project approvals, developer credibility, and local infrastructure before buying.

Q5. What types of projects are likely to benefit most?

- Ready-to-move residential housing with direct connectivity to the new expressways.

- Logistics parks, warehouses, and industrial hubs near UER-II interchanges.

- Commercial and retail spaces that can serve the growing residential clusters.

Q6. How should homebuyers approach investments along UER-II and Dwarka Expressway?

Buyers should prioritize ready or near-completion projects, check local civic amenities, and focus on long-term potential rather than quick speculation. It’s also wise to compare multiple developers, review RERA registrations, and consider affordability in the medium term.